Amidst the continually evolving realm of financial technology, one innovation that has distinctly seized worldwide attention is Bitcoin Prime platform an online trading platform. Originating in 2009 as the vanguard of cryptocurrencies, Bitcoin has traversed an extraordinary path from obscurity to pervasive recognition. This composition intricately examines the multifaceted dimensions of the Bitcoin phenomenon, delving into its inception, far-reaching consequences, and the fervent enthusiasm it has generated.

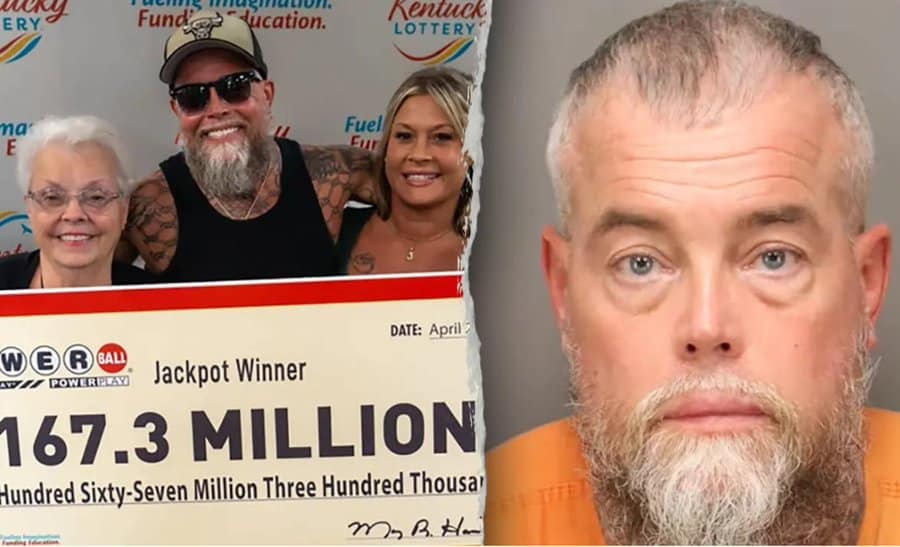

Featured Image VIA

Understanding The Genesis Of Bitcoin

Bitcoin’s Mysterious Creator: At the heart of the Bitcoin narrative lies a pseudonymous figure known as Satoshi Nakamoto. In 2008, Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlining the principles of a decentralized digital currency. Nakamoto’s identity remains shrouded in mystery, fueling both intrigue and skepticism.

Decentralization And Blockchain Technology: Bitcoin’s innovation lies in its utilization of blockchain technology. Blockchain operates as a distributed and immutable ledger, allowing transactions to be verified without the need for intermediaries. This decentralized nature addresses concerns of traditional currencies, such as inflation and centralized control.

The Bitcoin Hype: Catalysts And Controversies

Early Adopters and Enthusiasts: Bitcoin’s initial adopters were tech-savvy individuals who recognized its potential as an alternative to traditional financial systems. As the community grew, so did the enthusiasm around the technology’s disruptive potential.

Market Volatility and Speculation: While Bitcoin’s long-term viability is a topic of debate, its price volatility has attracted both investors and speculators. The cryptocurrency’s value has experienced meteoric rises and drastic falls, resulting in financial windfalls for some and losses for others.

Regulatory Challenges: Governments and financial institutions worldwide have grappled with how to regulate and incorporate cryptocurrencies into existing frameworks. The lack of a centralized authority poses challenges for regulation, leading to a complex legal landscape.

Bitcoin’s Real-World Applications And Impact

Financial Inclusion: Bitcoin has the potential to provide financial services to the unbanked and underbanked populations across the globe. By facilitating cross-border transactions without intermediaries, it offers an avenue for those excluded from traditional banking systems to participate in the global economy.

Remittances And Cross-Border Transactions: The remittance industry, which relies heavily on costly intermediaries, could be revolutionized by Bitcoin. Its low transaction fees and fast settlement times make it an attractive option for cross-border money transfers.

Challenges And Scalability: Despite its potential, Bitcoin faces challenges related to scalability and energy consumption. The process of mining, necessary for verifying transactions, requires significant computational power and energy, leading to concerns about environmental impact.

Navigating The Future: Opportunities And Considerations

Evolution of Cryptocurrencies: The success of Bitcoin has served as a foundational stepping stone for a myriad of alternative cryptocurrencies, each distinguished by its distinct attributes and practical applications. These digital assets persistently challenge the limits of what can be achieved in the sphere of decentralized finance, fostering innovation and experimentation across the financial landscape.

Institutional Adoption: The involvement of major financial institutions and corporations in the cryptocurrency space signifies a growing acceptance of digital assets. This institutional adoption could potentially bring greater stability and legitimacy to the market.

Education and Awareness: With the increasing integration of Bitcoin and cryptocurrencies into our daily lives, the importance of education becomes exceptionally pronounced. Acquiring a comprehensive grasp of the associated risks, advantages, and underlying mechanisms of these digital assets becomes a pivotal prerequisite for navigating the swiftly transforming terrain effectively. Informed decision-making within this dynamic landscape hinges on this foundational understanding.

Conclusion

The Bitcoin phenomenon stands as a compelling testament to human ingenuity and the formidable force of innovation. Beginning with its elusive creator and extending to its capacity for disruption, Bitcoin’s grasp on global intrigue remains undeniable. As the trajectory of Bitcoin unfolds, it becomes paramount to engage with this technological progression through a judicious lens, acknowledging both its pledges and the hurdles it presents on the horizon.

In summary, the evolutionary journey of Bitcoin stands as a vivid illustration of the ever-changing nature of the digital era. Undoubtedly, its profound influence on finance, technology, and the world economy is apparent, yet the road ahead is fraught with unpredictable factors. The extent to which Bitcoin’s passionate momentum translates into a sustained overhaul of the financial terrain remains uncertain. Nevertheless, a distinct reality emerges: Bitcoin has catalyzed a discourse that is destined to mold the trajectory of financial landscapes in the years ahead.